BANKING IS BELIEVING

News & Events

Security

Beware of Amazon Prime Day Scammers

Amazon Prime Days brings discounted prices along with new phishing scams from cybercriminals looking for any opportunity to capitalize. Phishing emails using the Amazon brand to add legitimacy top the list, but scams involving text messages and even phone calls saying they are from Amazon have been reported. These scams take into consideration the huge...

Security

Antivirus and Support Scams

The internet provides convenience and connectivity; however, it also entails risks such as online scams. Fake virus pop-ups and tech support scams are common threats, with the aim of deceiving unsuspecting users into compromising their security and finances. The Scams: Fake Virus Pop-ups: These deceptive pop-ups claim your computer is infected with a virus and...

Security

Don’t Take the Bait

Stop Smishing Scams Impersonating Amazon, DHL, USPS, and UPS! Have you ever received a text message about a missed delivery with a suspicious link? You’re not alone. Scammers often impersonate trusted delivery companies like Amazon, DHL, USPS, and UPS. Text scams (also known as “smishing”) are among the most common tactics scammers use to steal...

Security

Be Wary of Tech Support Scams

Cybercriminals often send fraudulent email or text messages, or call and claim to be from Microsoft, Apple, your anti-virus company or internet provider. They may even set up fake online pop-ups with warning messages to call and get the “issue” fixed. They offer to help solve your computer problems or sell you a software license....

Security

How To Create Strong Passwords

As technology evolves, so do the methods employed by cybercriminals. One of the best ways to protect yourself, your devices, and your accounts is to exercise some simple password dos and don’ts. Do: Use a password that contains uppercase letters, lowercase letters, numbers and symbols. Longer passwords tend to provide heightened security against various hacking...

What's New

Real-Time Transaction & Balance Alerts for Business

Businesses, including LLCs and Corporations, can now request real-time transaction and balance alerts by completing a simple enrollment form. With Real-Time Alerts, businesses can protect their accounts by receiving real-time alerts via text or email to an authorized signer on the account. Stay on top of your finances – get notified of withdrawals over a...

Security

Don’t Let Your Checks Get Washed

Anyone who writes and mails a check is at risk for fraud. Longer lasting gel or hybrid ink is harder for fraudsters to clean off in their efforts to change the recipient and/or dollar amount. Write your checks with anti-fraud ink to help keep them intact and protect yourself from potential losses. Be sure to also:...

Security

Signs of Elder Financial Abuse

Many elderly people are targets of financial exploitation because after having a lifetime to acquire and save, they tend to possess more financial assets and property, making them attractive targets for financial exploitation. Sadly, many who are financially exploited experience this abuse at the hands of trusted caregivers or family members. This can make the...

Security

Spotting and Preventing Wire Fraud

Wire fraud is largely a result of compromised emails or an account takeover. This form of fraud can be difficult to detect because fraudsters may use a valid email address, craft their communication to mimic the actual account owners, and add urgency to the request. Sometimes, wire instructions are expected and the communication channel used...

Security

Protect Yourself from “Smash-and-Grab” Crimes

Thieves are always looking for opportunities to steal from parked cars, even those in residential driveways. This type of theft is called “smash-and-grab”. It refers to perpetrators smashing car windows parked in places like gyms, beaches and lakes to grab wallets or purses that are often left behind during these activities. These places are targeted...

Security

Tax Season and Cybercriminals

Cybercriminals love tax season. The vast amounts of personal and financial information shared online during this time of year make it an ideal environment for them. These scammers use high pressure tactics in hopes that you will respond – a voicemail message claiming that the IRS is filing a lawsuit unless you call a number...

Security

Protect Yourself From Tax Fraud

As tax season gets underway, so does tax-related fraud. Know what to look for and take steps to protect sensitive information. SPOTTING TAX FRAUD Phone Calls: The IRS typically contacts individuals via written notification before calling about tax issues. If someone claims to be from the IRS by phone without prior written notice, end the...

Security

What You Need To Know About Scams Related to the Collapse of SVB

Shortly after the collapse of Silicon Valley Bank (SVB) the number of domain registrations containing “SVB” nearly tripled. Many of these domains were being registered by bad actors for use in cryptocurrency scams, phishing campaigns and fraud attempts. What You Need To Know Scammers are taking advantage of the current situation and impersonating SVB, Circle...

Security

LastPass Password Manager Breach

LastPass, the world’s most popular password manager, was breached twice in 2022. The second breach led to bad actors obtaining encrypted copies of users’ vault data – which includes usernames and passwords. Although the encryption applied to these vaults is very strong, it is not invulnerable. What to do? Enable multi-factor authentication everywhere it is...

Security

Keeping a Watchful Eye During the Holidays

You decided to brave the holiday crowds. You’ve been waiting in line for hours to purchase a must-have gift, finally make it to the checkout to pay, and the transaction is declined. GASP! What? How!? A call to the card issuer reveals that your information has been stolen, and your account has been maxed out....

Security

Cybercrime This Holiday Season

This holiday season, use caution when shopping online. Be wary of these common holiday scams. Remember to always think before you click. Too-Good-To-Be-True Sales & Deals If you’re like many holiday shoppers looking for a good deal on gifts, remember to avoid any sales that seem too-good-to-be-true (because they probably are). Phishing emails or ads...

Security

How Fraudsters Are Exploiting Digital Platforms with Creative Phishing Scams

In an increasingly digital world, phishing scams are becoming more prevalent. The fraudsters behind these scams are finding more creative ways to exploit digital platforms like email, text, phone and peer-to-peer (P2P) payment apps. According to the Federal Trade Commission’s report on fraud, it’s estimated that American consumers lost a staggering $5.8 billion to phishing...

Security

Protect Yourself from Peer-to-Peer (P2P) Related Fraud

Peer-to-peer (P2P) payment apps like Zelle, Venmo and CashApp enable users to conveniently send money quickly — and fraudsters aren’t afraid of exploiting them. P2P related fraud has been on the rise in recent years, with bad actors finding creative ways to exploit P2P payment apps. These schemes include phishing, smishing, vishing, spoofing phone numbers,...

Security

Account Alerts

Account and Service alerts provide real-time updates on a variety of account activities to better manage your finances. Choose to receive email or text alerts – they’re user-friendly and help you keep track of money moving in and out of your accounts to prevent overdrafts, avoid fraud and keep a closer eye on your finances....

Security

Positive Pay can protect businesses from check fraud loss

Increases in business check fraud often originate from unattended mail. It is crucial to use a P.O. Box or ensure direct delivery to an office address. If checks fall into the wrong hands, criminals gain access to sensitive business information. This not only enables them to modify existing checks but also to produce counterfeit ones...

Security

Gift Card Scams

Scammers who ask for payment in gift cards often impersonate a well-known business or government agency, commonly with promises of tech or security support, which can be convincing. If you receive a call from someone claiming to be from Microsoft offering to help fix your infected computer for $200 in Target gift cards, that’s a...

Security

How to Spot a Phishing Scam

Phishing is a common type of cybercrime that fraudsters use to obtain sensitive, personal information such as usernames, passwords, card numbers, or account information by posing as a trustworthy source, such as a reputable company. Phishing is commonly done through email, although social networking sites and chatting apps are becoming increasingly common methods as well....

Security

How to Spot Business Email Compromise

You receive an email from a customer requesting you view a secure document or complete a Request for Proposal (RFP). The message came from someone you’ve interacted with before, but you weren’t expecting this request. The sender’s information appears to be legitimate, and your email filter didn’t flag it as suspicious, but who is really...

Security

How To Increase Your Business Cybersecurity

Nearly half of all cyberattacks target small businesses. Yet only 40% of small businesses have a cybersecurity policy. Security breaches surged in the pandemic as more employees worked remotely, making data even more accessible to cybercriminals. As businesses work to recover from the COVID-19 pandemic, their vulnerability to fraud is at an all-time high. Just...

Security

Beware Of Text Messages Claiming That Your Debit Card Has Been Locked

Phishing text messages are becoming an increasingly common method for fraudsters to gain access to confidential information. Be on the lookout for text messages that claim your debit card is locked or has been blocked due to a recent transaction and ask you to respond if the activity is authorized or not, as shown in...

Security

Should A Company Pay A Ransom?

Ransomware attackers specialize in penetrating corporate networks, and sometimes specifically target a business’ backup systems, making it difficult – or impossible – to remediate the harm of an attack. The frequency and size of ransomware incidents have increased significantly in recent years. No company is safe from being targeted. How You Can Help Protect Your Business...

What's New

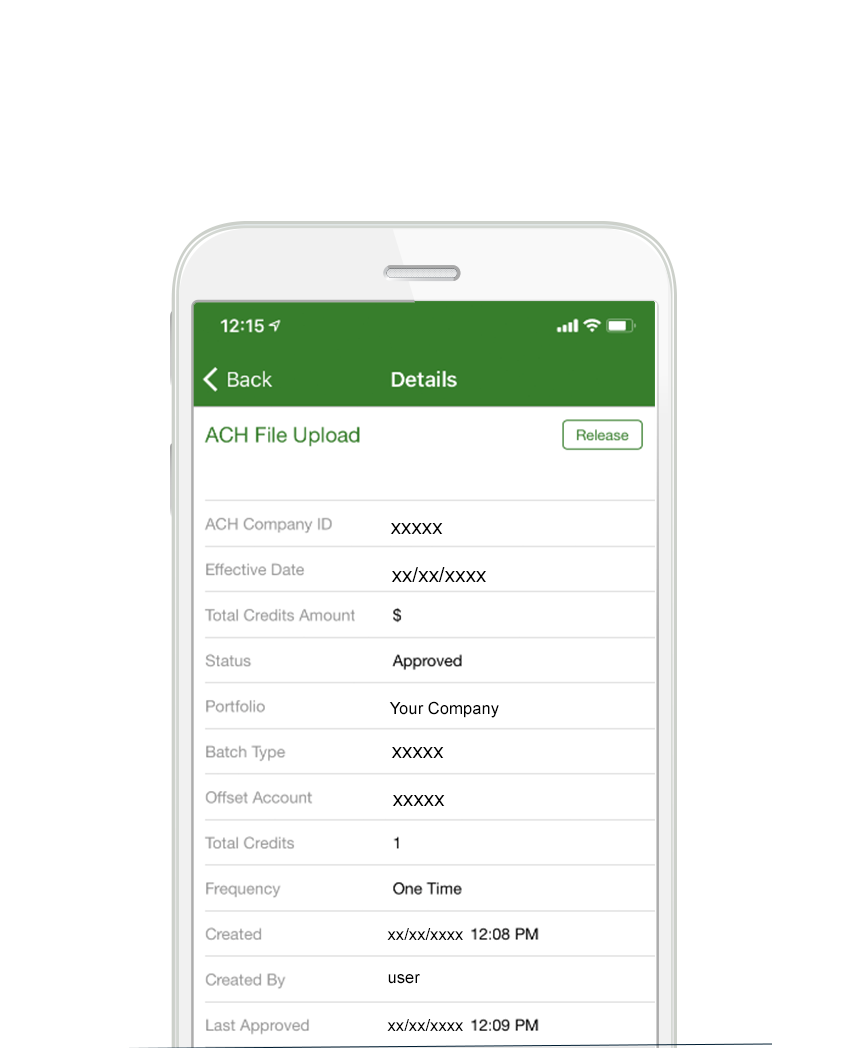

Approve ACH or Wire Payments On-The-Go

With mobile approval for ACH and wires, it’s more convenient than ever for businesses to increase security and utilize dual control. Authorized users can quickly and easily approve, or release, ACH and wire payments on-the-go with the GSB mobile app. Requiring a second approver for ACH originations and wire transfers will give you peace of...

Security

SBA PPP Borrower Data Publicly Released

Third-party businesses are using information from a court-ordered public release of Small Business Administration (SBA) Paycheck Protection Program (PPP) borrowers to deceptively market themselves. Their communications may reference Gorham Savings Bank and may even imply that we have an affiliation. Please be aware that we will communicate directly with you about your PPP loan and...

Security

SBA COVID-19 Relief Scams and Fraud Alerts

Please be aware of a variety of malicious attempts by cyber-criminals taking advantage of the Small Business Administration (SBA)’s COVID-19 relief efforts to gather sensitive information and steal funds from businesses. Always think before you click! Grants/Loans The SBA does not initiate contact on either loans or grants. If you are proactively contacted by someone...

Security

Unemployment Insurance Program Targeted by Fraudsters

The US Secret Service is warning of a well-organized fraud ring exploiting the COVID-19 crisis in order to commit large-scale fraud against state unemployment insurance programs. Individuals are receiving multiple deposits from various State Unemployment Benefit Programs. It is assumed the fraud ring behind this possesses a substantial database of Personally Identifiable Information (PII) in...