BANKING IS BELIEVING

News & Events

What's New

Retirement Ready | An Overview of the MERIT Program

Starting in spring 2024, business owners with 5+ employees will be required to register to offer a workplace retirement program through the Maine Retirement Investment Trust (MERIT). The MERIT program helps employees without an employer retirement plan save for retirement by requiring an automatic payroll deduction of 5% of W-2 wages to a Roth IRA....

What's New

Real-Time Transaction & Balance Alerts for Business

Businesses, including LLCs and Corporations, can now request real-time transaction and balance alerts by completing a simple enrollment form. With Real-Time Alerts, businesses can protect their accounts by receiving real-time alerts via text or email to an authorized signer on the account. Stay on top of your finances – get notified of withdrawals over a...

What's New

Employee Retention Refundable Tax Credit

Did you operate your business while paying your employees during the pandemic? Your business may be eligible for the Employee Retention Credit (ERC), which could amount to thousands back to grow your business. The ERC is a refundable tax credit for businesses that continued to pay employees while shut down during the pandemic. Employers can...

What's New

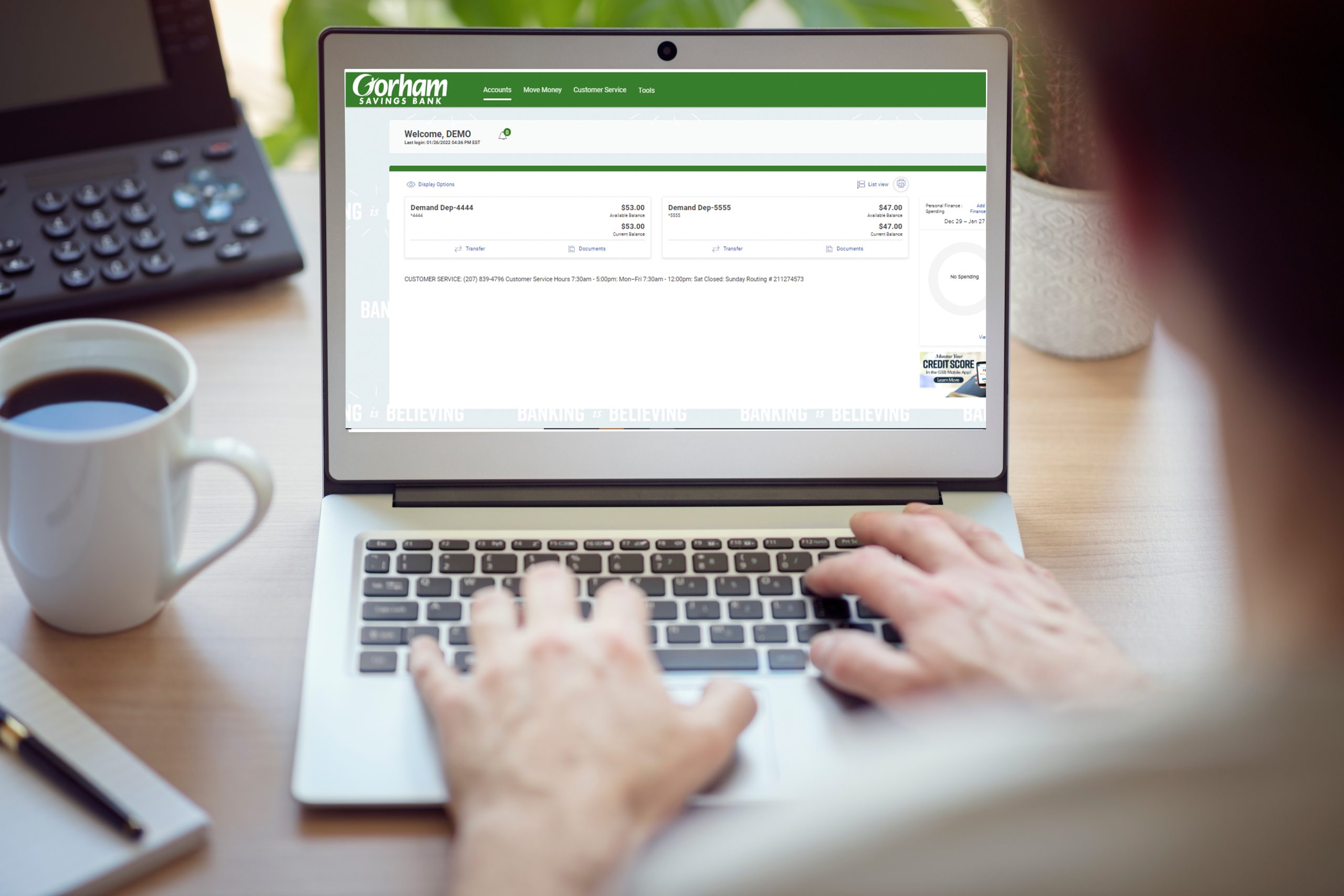

A Better Business Online Banking Experience

Online Banking will soon have a more modern look and feel! As your business is converted to the new interface over the next several months, you’ll notice: Streamlined navigation making it easier to find the tools you need to manage your business accounts The same advanced security you know and trust Plus, you’ll now have...

What's New

Preparing for a Changing Economy

As the Federal Reserve raises interest rates to combat inflation, it’s important to understand that its action will translate into higher rates for mortgages, home equity lines of credit, auto loans, credit cards, and a wide range of financial products. The goal of this policy is to reduce demand and lower spending to slow inflation,...

What's New

New Logo Reflects Brand Values and Signifies a New Day at GSB

Gorham Savings Bank unveiled its new logo today with signage on its Main Street, Gorham and Marginal Way, Portland office building. The new mark will be rolled out across the Bank’s additional ten branches and remaining office locations, and begin appearing on other branded materials, over the next several weeks. The logo was the culmination of...

What's New

We’re Building A Better Online Banking Experience

Online Banking will soon have a more modern look and feel! Customers will be converted in stages over the next several months. As you are converted to the new system, you’ll notice: Streamlined navigation making it easier to find the tools you need to manage your finances Touch-screen technology A consistent experience between Online Banking...

What's New

New City of Portland Microenterprise Grant

The City of Portland announced a new Microenterprise grant program to aid existing and new businesses that have been or continue to be impacted by the pandemic. The grant will provide up to $7,500 in funds for rent, payroll, equipment, insurance, inventory, and other working capital needs. To be eligible: The business or nonprofit must be...

What's New

Branch Lobby FAQs

1. What precautions does GSB have in place? To maintain the health and safety of our employees and customers we are observing the following COVID safety protocols. Questions? Call our Resource Team at (207) 221-8432. Have PPE and hand sanitizer available for use Utilize germ shields at teller stations and customer service desks Direct traffic...

What's New

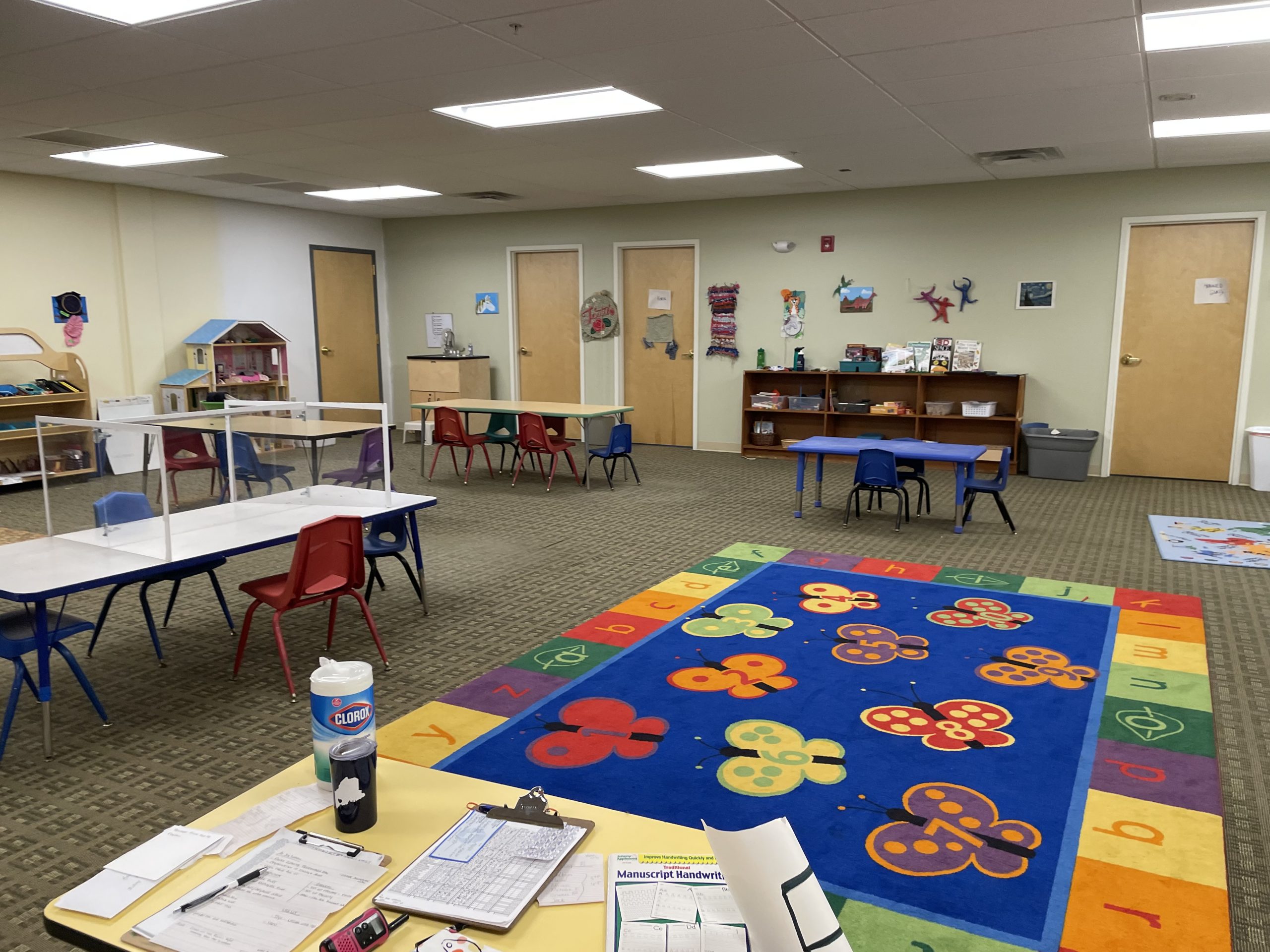

GSB Leases Space to Gorham Arts Alliance

Gorham Savings Bank is pleased to announce a unique local partnership with the Gorham Arts Alliance (GAA) to utilize the first floor of its Operations Center in Gorham for their school aged enrichment programs, homeschool and special needs art and dance programs, as well as adult education classes. The Arts Alliance was looking for a...

What's New

2021 Child Tax Credit Payments Started July 15, 2021

The 2021 Child Tax Credit in President Biden’s American Rescue Plan provides the largest Child Tax Credit ever and historic relief to families struggling financially amidst the pandemic. If you qualify for the 2021 child tax credit, you may have already received your first advance monthly payment on or around July 15, 2021. Before you...

What's New

Credit Insights

Credit Insights is now available in the GSB Mobile App! Access your credit score and credit report, and can gain a better understanding of the key factors that impact your score. The service is free and allows you to: View your full credit report See what affects your credit score Get personalized tips for credit...

What's New

A Third Round of Stimulus Checks

With Congress recently approving a $1.9 trillion COVID-19 relief bill, a third round of economic impact payments (stimulus checks) is expected starting March 17th. The bill provides $1,400 to individuals making up to $75,000 per year and $2,800 to couples making up to $150,000, with payments phased out for higher incomes. An additional $1,400 payment...

What's New

Touch-Free Payments With Contactless Cards

Speed, simplicity, and security wherever the contactless symbol is displayed Gorham Savings Bank is now issuing contactless debit cards. When you receive your new GSB card, just look for the contactless symbol when paying for items, tap your card against the symbol on the payment terminal until the light turns green, and listen for a...

What's New

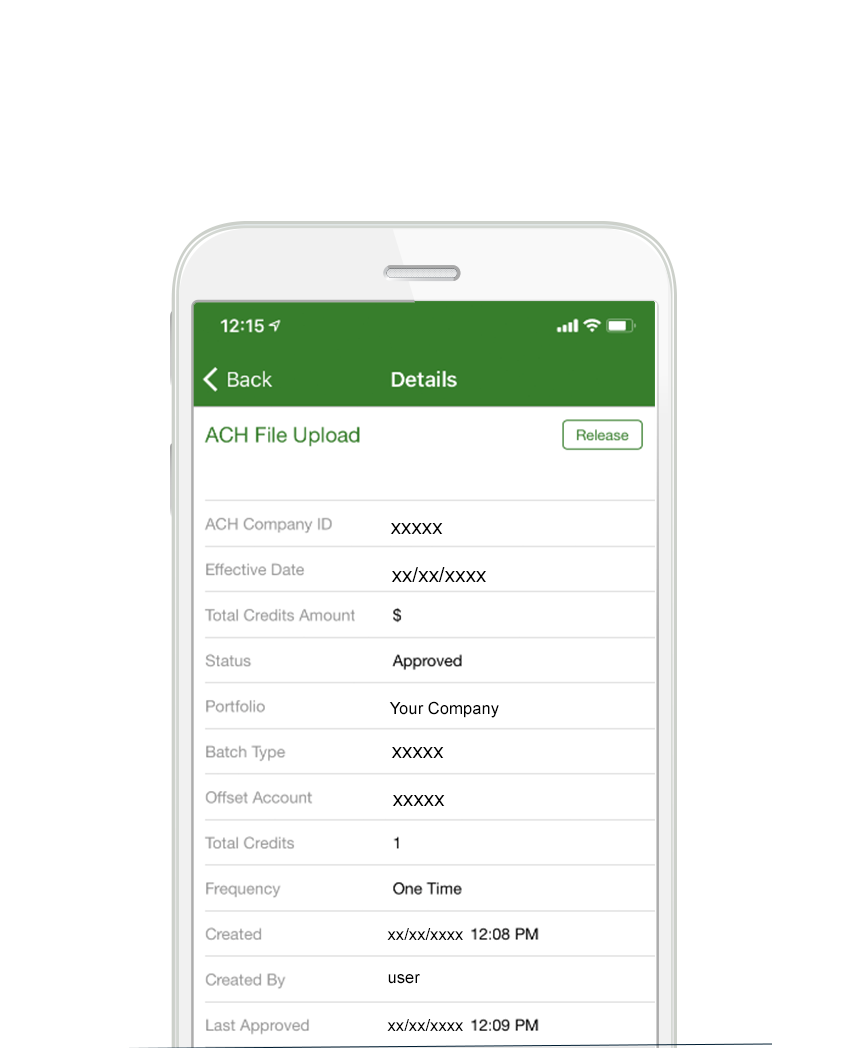

Approve ACH or Wire Payments On-The-Go

With mobile approval for ACH and wires, it’s more convenient than ever for businesses to increase security and utilize dual control. Authorized users can quickly and easily approve, or release, ACH and wire payments on-the-go with the GSB mobile app. Requiring a second approver for ACH originations and wire transfers will give you peace of...

What's New

GSB Mobile App – Deposit A Check, Pay Back A Friend & More

The GSB Mobile App makes managing your money from home or on-the-go convenient and easy. Simply download the Gorham Savings Bank app for iOS or Android to deposit a check, pay back a friend, lock a lost or misplaced GSB debit card, and monitor credit and account activity to help protect against fraud. With The...

What's New

PPP Loan Forgiveness Program

The SBA has created two applications – PPP Loan Forgiveness Application Form 3508EZ and PPP Loan Forgiveness Application Form 3508. Please refer to Application Form 3508EZ Instructions for Borrowers and Application Form 3508 Instructions for Borrowers to determine which application should be completed. Additional information regarding the use of SBA Form 3508EZ is also included...

What's New

Portland Small Business Grant + Loan Programs

On May 19th, the City of Portland launched three new loan and grant programs for small businesses. Business Assistance Program for Job Creation (Rehiring) The City of Portland’s COVID-19 Business Assistance Program for Job Creation (Rehiring) (BAP) provides $5,000 in grant funding to small businesses for rehiring two or more full-time employees that were on the payroll as of January 31, 2020....

What's New

Three Additional Branches Equipped with Video Teller Machines

We’re working hard to make it easier to manage your accounts remotely during the current health crisis. That’s why we’ve added Video Teller Machines in Waterboro, Westbrook & Windham. Three of our ATM locations have been upgraded to Video Teller Machines with an increased level of service – just touch the screen to connect with...

What's New

GSB Will Continue To Operate In Its Current Model

In keeping with Governor Mills latest statewide directive and the City of Portland’s recent Emergency Order, identifying banks as ‘essential services,’ GSB, across our footprint, will continue to operate in its current model, serving customers via drive thru, Video Teller Machines, ATMs and online and mobile channels. GSB is carefully monitoring guidance from the federal,...

What's New

Our Proactive Response to COVID-19

To better ensure the health and safety of our employees and customers, we are restricting all branches to DRIVE THRU SERVICE ONLY until further notice. We’re Prepared Our crisis action team has been proactively monitoring the outbreak. We regularly review guidance from federal, state and local authorities to keep our employees informed and implement best practices,...

What's New

GSB’s LaunchPad Opens March 1

Kate McAleer (founder, Bixby & Co.), Becky McKinnell (founder, iBec Creative) and Rich Peterson (president, MaineHealth and CEO, Maine Medical Center) will help judge this year’s competition Gorham Savings Bank will begin accepting applications on March 1 for its eighth annual LaunchPad small business competition. In the competition, the premier event of its type in...

What's New

GSB Transitions Email Address to @GorhamSavings.Bank

In 2017, GSB changed its website address from GorhamSavingsBank.com to GorhamSavings.Bank for added security. Dot bank domains are reserved exclusively for the banking industry, so they are more difficult to spoof and help prevent users from being redirected to a fake bank website. To complete the transition, we have updated our email addresses as well,...

What's New

Our Newest Branch is Now Open in Yarmouth

Gorham Savings Bank has opened its newest branch in the historic Grand Trunk Railroad Depot on Main Street Yarmouth, after a year-long restoration project. The restoration project is a collaboration with historic preservation property developer and owner of the Depot, Ford Reiche, who has rehabilitated four other properties listed on the National Register of Historic...

What's New

Finalists Announced for 2019 LaunchPad Competition

Now in its seventh year, LaunchPad helps Maine’s innovators and entrepreneurs reach the next level Gorham Savings Bank has selected five Maine businesses as the finalists of its seventh annual LaunchPad small business competition. From an applicant pool of over 150 businesses, Casco Bay Creamery, CourseStorm, GO Lab, Sidewalk Buttler, and Vintage Maine Kitchen rose...

What's New

New GSB Mobile App Feature – PayPal Linking

Now mobile banking customers can link their debit card to their new or existing PayPal account using the GSB Mobile App. If there are insufficient funds in you PayPal balance, your purchase can be covered quickly and easily, without having to enter card numbers or other personal information to complete your transaction. Linking a debit...

What's New

New Money Management Tool Available in Online Banking & The Mobile App

Introducing Personal Finance, a money management tool now available in online and mobile banking. With customized budgeting tools, smart expense tracking, and mobile access, you can manage your finances with ease, from anywhere. Manage All Your Accounts – Track finances across all accounts, in one place. Track Spending – Get powerful insights on when, where, and how you spend....

What's New

Online Banking Has A New Look!

We’re excited about the recent changes within Online Banking (OLB) – designed to provide an optimized experience whether you access it from a desktop, tablet or smartphone. OLB now adapts to your device and includes touch-screen capability! We also recognize that all change comes with a period of re-adjustment, so we have developed a list...

What's New

New Look and Feel Coming Soon to Online Banking

We’re making improvements to online banking — helping you stay connected to your money, with added convenience. On October 21, 2018, you’ll notice: Optimized experience Whether you access online banking from a desktop, tablet or smartphone — the experience will adapt to your device — and include touch-screen capability. Improved navigation and functionality Our new,...

What's New

Lock Your Debit Card with Card Controls

GSB retail debit card customers can manage and protect their card right from their phone. CONTROL YOUR DEBIT CARD FROM YOUR SMARTPHONE With Card Controls in the GSB mobile app, you can control how, when and where your card is used, right from your mobile device. So, if you misplace your GSB debit card—or suspect...