BANKING IS BELIEVING

News & Events

Security

Beware of Amazon Prime Day Scammers

Amazon Prime Days brings discounted prices along with new phishing scams from cybercriminals looking for any opportunity to capitalize. Phishing emails using the Amazon brand to add legitimacy top the list, but scams involving text messages and even phone calls saying they are from Amazon have been reported. These scams take into consideration the huge...

Press Room

LaunchPad Competition Returns: Applications Open July 15 for 11th Annual Small Business Event

Gorham Savings Bank announced the application for its annual LaunchPad small business competition opened today, Monday, July 15. Now in its 11th year, LaunchPad provides innovative Maine-based small businesses with the opportunity to compete for a $50,000 grant from the bank to help them scale up. “We are thrilled to begin the 2024 LaunchPad season,...

Security

Antivirus and Support Scams

The internet provides convenience and connectivity; however, it also entails risks such as online scams. Fake virus pop-ups and tech support scams are common threats, with the aim of deceiving unsuspecting users into compromising their security and finances. The Scams: Fake Virus Pop-ups: These deceptive pop-ups claim your computer is infected with a virus and...

Press Room

Marathon Contributions Total $60,000 for Charitable Organizations

Bob Dunfey, volunteer race director for the Gorham Savings Bank Maine Marathon, and Steve deCastro, president and CEO of Gorham Savings Bank, title sponsor since 2010, announced today that Percival Baxter Foundation, Maine Paws for Veterans, Maine Senior Games, Riding to the Top, Saltwater Classroom, and Strong Girls United are the primary race beneficiaries for...

Security

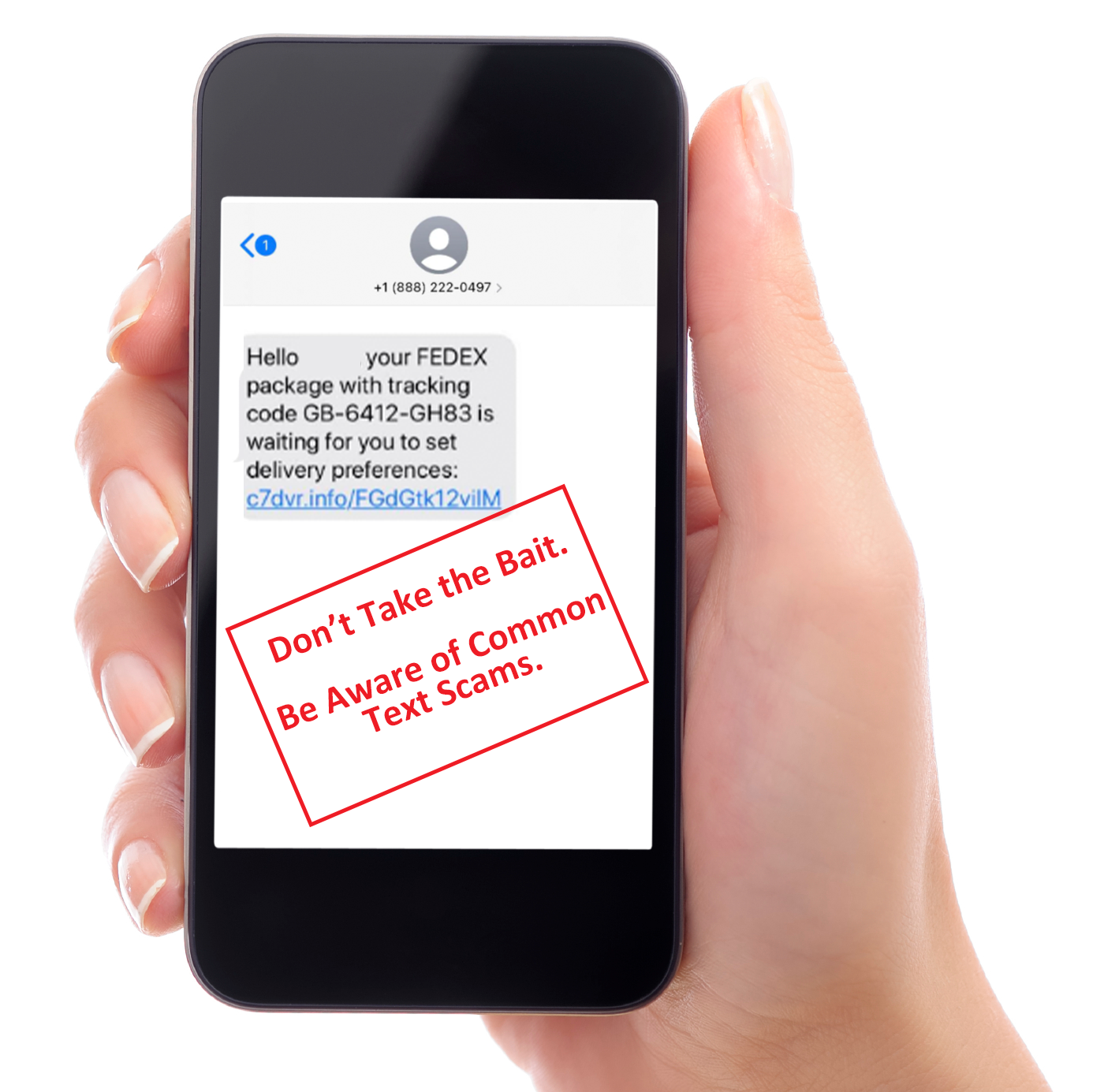

Don’t Take the Bait

Stop Smishing Scams Impersonating Amazon, DHL, USPS, and UPS! Have you ever received a text message about a missed delivery with a suspicious link? You’re not alone. Scammers often impersonate trusted delivery companies like Amazon, DHL, USPS, and UPS. Text scams (also known as “smishing”) are among the most common tactics scammers use to steal...

Press Room

Town of Gorham Boosts Local Business with New Capital Expenditure Matching Grant Program

On January 2, 2024, the Gorham Town Council voted unanimously in support of grant funding awarded to local businesses as part of a new Capital Expenditure Matching Grant program. Eight local businesses were awarded a total of $45,000 in matching grant funds as part of a competitive application process. In support of the program, Gorham...

General

FinCEN Beneficial Ownership Reporting Begins 1/1/24

In 2024, most companies must report information about their beneficial ownership—the individuals who directly own and control them—to the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of Treasury, as required by the Corporate Transparency Act. Filing is free, can be completed online, and only needs to be submitted once unless information...

Press Room

GSB Pledges $200,000 to Avesta Housing to Address Maine’s Housing Crisis

Multi-Year Gift Will Help Provide Energy-Efficient Homes And Support Services Gorham Savings Bank has pledged $200,000 to Avesta Housing, the largest nonprofit affordable housing provider in northern New England, to aid in the development of energy-efficient affordable homes and support services for people in need over the next four years. The multi-year gift will address...

What's New

Retirement Ready | An Overview of the MERIT Program

Starting in spring 2024, business owners with 5+ employees will be required to register to offer a workplace retirement program through the Maine Retirement Investment Trust (MERIT). The MERIT program helps employees without an employer retirement plan save for retirement by requiring an automatic payroll deduction of 5% of W-2 wages to a Roth IRA....

Press Room

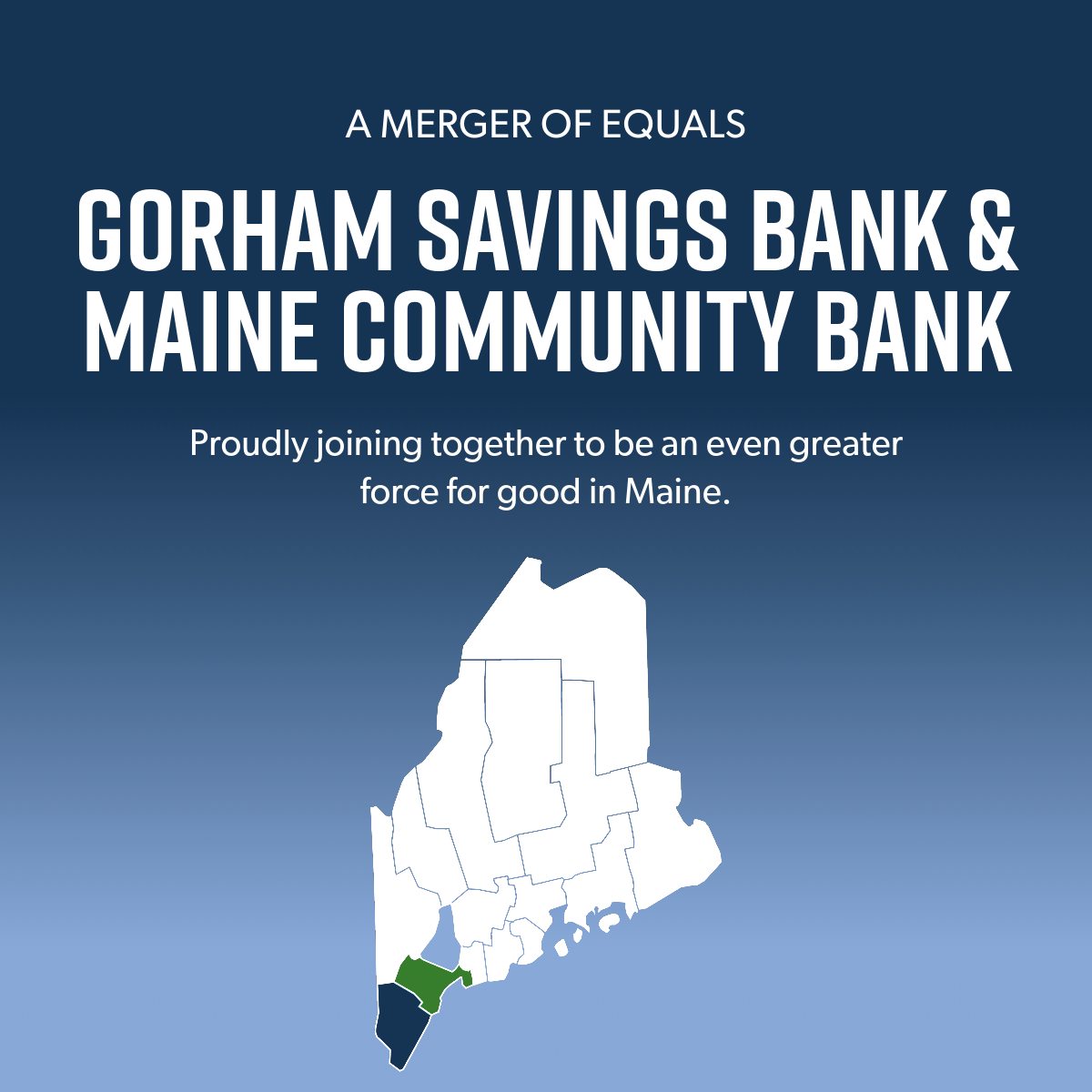

Gorham Savings Bank and Maine Community Bank to Combine in a Merger of Equals

Maine Community Bancorp, MHC, the parent mutual holding company for Maine Community Bank (“Maine Community Bank”), and Gorham Bancorp, MHC, the parent mutual holding company for Gorham Savings Bank (“Gorham Savings Bank”), are pleased to announce that they have entered into a definitive agreement to merge under the Maine Community Bank name. The combined company...

Press Room

deCastro’s 25-year JA Maine Board Tenure Recognized with Prestigious National Award

Shared from the Junior Achievement of Maine. Junior Achievement of Maine is proud to announce that Steve deCastro, President & CEO of Gorham Savings Bank in Maine, has been awarded the esteemed Junior Achievement USA Silver Award. Steve’s dedication, outstanding leadership, and an incredible 25-year tenure on the JA Maine Board of Directors have earned him...

Press Room

Bookclubs Earns Gorham Savings’ $50,000 Grant at 2023 LaunchPad Competition

Bookclubs, a social network and app for readers that makes it easy to start, manage, and join a book club, was named the 2023 winner of Gorham Savings Bank’s annual LaunchPad small business competition and earned its corresponding $50,000 no-strings-attached grant. The company was chosen from among five finalists—all innovative, local entrepreneurs—who pitched Tuesday evening...

Press Room

2023 LaunchPad Finalists Unveiled: Maine’s Innovators Shine Bright

The 10th Annual Competition saw a historic moment as the African Language Learning App, NKENNE, became the first-ever business to be named a finalist after winning the Emerging Business Award in 2022. GSB has selected five finalists for its annual LaunchPad small business competition. Out of a vibrant and diverse mix of small businesses across...

Press Room

VP Dignitary Titles Awarded to AL Dhamen and Ouellette

GSB announced today the designation of Ali AL Dhamen, Information Security Officer, and Caitlin Ouellette, Senior Marketing Specialist, as Vice President. AL Dhamen has a strong background in information security and has been instrumental in building the bank’s cybersecurity program. He oversees GSB’s information security and third-party risk management programs. “Ali is a highly skilled...

Security

Be Wary of Tech Support Scams

Cybercriminals often send fraudulent email or text messages, or call and claim to be from Microsoft, Apple, your anti-virus company or internet provider. They may even set up fake online pop-ups with warning messages to call and get the “issue” fixed. They offer to help solve your computer problems or sell you a software license....

Security

How To Create Strong Passwords

As technology evolves, so do the methods employed by cybercriminals. One of the best ways to protect yourself, your devices, and your accounts is to exercise some simple password dos and don’ts. Do: Use a password that contains uppercase letters, lowercase letters, numbers and symbols. Longer passwords tend to provide heightened security against various hacking...

What's New

Real-Time Transaction & Balance Alerts for Business

Businesses, including LLCs and Corporations, can now request real-time transaction and balance alerts by completing a simple enrollment form. With Real-Time Alerts, businesses can protect their accounts by receiving real-time alerts via text or email to an authorized signer on the account. Stay on top of your finances – get notified of withdrawals over a...

Press Room

Application for 10th Annual LaunchPad Competition Now Open

Gorham Savings Bank announced today the application period for its annual LaunchPad small business competition will open Monday, July 17. Celebrating its 10th year, LaunchPad provides innovative Maine-based small businesses with the opportunity to compete for a $50,000 grant from the bank to help launch the winner to the next level. “It’s amazing to think...

Security

Don’t Let Your Checks Get Washed

Anyone who writes and mails a check is at risk for fraud. Longer lasting gel or hybrid ink is harder for fraudsters to clean off in their efforts to change the recipient and/or dollar amount. Write your checks with anti-fraud ink to help keep them intact and protect yourself from potential losses. Be sure to also:...

Security

Signs of Elder Financial Abuse

Many elderly people are targets of financial exploitation because after having a lifetime to acquire and save, they tend to possess more financial assets and property, making them attractive targets for financial exploitation. Sadly, many who are financially exploited experience this abuse at the hands of trusted caregivers or family members. This can make the...

What's New

Employee Retention Refundable Tax Credit

Did you operate your business while paying your employees during the pandemic? Your business may be eligible for the Employee Retention Credit (ERC), which could amount to thousands back to grow your business. The ERC is a refundable tax credit for businesses that continued to pay employees while shut down during the pandemic. Employers can...

Security

Spotting and Preventing Wire Fraud

Wire fraud is largely a result of compromised emails or an account takeover. This form of fraud can be difficult to detect because fraudsters may use a valid email address, craft their communication to mimic the actual account owners, and add urgency to the request. Sometimes, wire instructions are expected and the communication channel used...

Security

Protect Yourself from “Smash-and-Grab” Crimes

Thieves are always looking for opportunities to steal from parked cars, even those in residential driveways. This type of theft is called “smash-and-grab”. It refers to perpetrators smashing car windows parked in places like gyms, beaches and lakes to grab wallets or purses that are often left behind during these activities. These places are targeted...

Press Room

Health Care Executive Joins Board of Directors

Gorham Savings Bank, a leading southern Maine financial services institution, has announced the appointment of Katie Fullam Harris to its board of directors. Harris, currently serving as Chief Government Affairs Officer for MaineHealth, brings extensive public policy and regulatory compliance experience to the board. In her role at MaineHealth, the state’s largest health care system,...

What's New

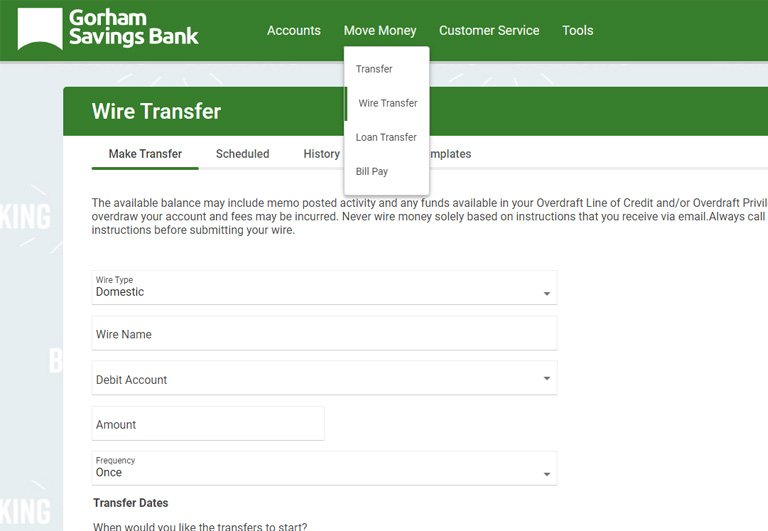

Create and Send Online Wires

Customers are now able to create and send wire transfers in Online Banking. This change makes sending wires easier and much more convenient. Log in and access the wire transfer tool under the “Move Money” dropdown menu. GSB will no longer accommodate wire transfer requests via secure message or by phone. Customers can visit a branch or...

Security

Tax Season and Cybercriminals

Cybercriminals love tax season. The vast amounts of personal and financial information shared online during this time of year make it an ideal environment for them. These scammers use high pressure tactics in hopes that you will respond – a voicemail message claiming that the IRS is filing a lawsuit unless you call a number...

Security

Protect Yourself From Tax Fraud

As tax season gets underway, so does tax-related fraud. Know what to look for and take steps to protect sensitive information. SPOTTING TAX FRAUD Phone Calls: The IRS typically contacts individuals via written notification before calling about tax issues. If someone claims to be from the IRS by phone without prior written notice, end the...

Security

What You Need To Know About Scams Related to the Collapse of SVB

Shortly after the collapse of Silicon Valley Bank (SVB) the number of domain registrations containing “SVB” nearly tripled. Many of these domains were being registered by bad actors for use in cryptocurrency scams, phishing campaigns and fraud attempts. What You Need To Know Scammers are taking advantage of the current situation and impersonating SVB, Circle...

General

GSB Is Here For You, Always

In the past few days we’ve all seen numerous reports regarding the financial services sector. These reports have raised a few concerns and caused some to question things beyond the two banks in the news. That said, I thought it important to let you know that there are notable differences between Gorham Savings Bank and...

Press Room

Marathon Contributions Total $60,000 for Charitable Organizations

Bob Dunfey, volunteer race director for the Gorham Savings Bank Maine Marathon, and Steve deCastro, president and CEO of Gorham Savings Bank, title sponsor since 2010, announced today that The Ecology School, Maine Children’s Cancer Program, Veggies to Table, and YMCA Camp of Maine are the primary race beneficiaries for 2023. The Ecology School Saco...