BANKING IS BELIEVING

News & Events

General

Maine District Office Presents GSB With SBA’s 2022 District Director Award

Gorham Savings Bank was recently awarded the U.S. Small Business Administration’s 2022 District Director Award in Maine for completing eight 504 loans totaling $7.9 million, thirty-three 7a loans totaling nearly $5.2 million which, when combined with SBA’s portion of the loans, represented about $13 million in financing to small businesses here in Southern Maine. SBA...

Press Room

Gorham Savings Bank Maine Marathon Delivers Early Holiday Gift to Educate Maine

The Gorham Savings Bank Maine Marathon, Half Marathon, and Relay exceeded expectations by raising a record-breaking $506,000. The unexpected additional revenue allowed race organizers to brighten the holiday season for Educate Maine with a gift of $15,000. “Once again, thanks to the generosity of our running community, event revenue came in higher than projected,” said Bob Dunfey, volunteer...

Security

Keeping a Watchful Eye During the Holidays

You decided to brave the holiday crowds. You’ve been waiting in line for hours to purchase a must-have gift, finally make it to the checkout to pay, and the transaction is declined. GASP! What? How!? A call to the card issuer reveals that your information has been stolen, and your account has been maxed out....

Security

Cybercrime This Holiday Season

This holiday season, use caution when shopping online. Be wary of these common holiday scams. Remember to always think before you click. Too-Good-To-Be-True Sales & Deals If you’re like many holiday shoppers looking for a good deal on gifts, remember to avoid any sales that seem too-good-to-be-true (because they probably are). Phishing emails or ads...

Security

How Fraudsters Are Exploiting Digital Platforms with Creative Phishing Scams

In an increasingly digital world, phishing scams are becoming more prevalent. The fraudsters behind these scams are finding more creative ways to exploit digital platforms like email, text, phone and peer-to-peer (P2P) payment apps. According to the Federal Trade Commission’s report on fraud, it’s estimated that American consumers lost a staggering $5.8 billion to phishing...

What's New

A Better Business Online Banking Experience

Online Banking will soon have a more modern look and feel! As your business is converted to the new interface over the next several months, you’ll notice: Streamlined navigation making it easier to find the tools you need to manage your business accounts The same advanced security you know and trust Plus, you’ll now have...

What's New

Preparing for a Changing Economy

As the Federal Reserve raises interest rates to combat inflation, it’s important to understand that its action will translate into higher rates for mortgages, home equity lines of credit, auto loans, credit cards, and a wide range of financial products. The goal of this policy is to reduce demand and lower spending to slow inflation,...

What's New

New Logo Reflects Brand Values and Signifies a New Day at GSB

Gorham Savings Bank unveiled its new logo today with signage on its Main Street, Gorham and Marginal Way, Portland office building. The new mark will be rolled out across the Bank’s additional ten branches and remaining office locations, and begin appearing on other branded materials, over the next several weeks. The logo was the culmination of...

Security

Protect Yourself from Peer-to-Peer (P2P) Related Fraud

Peer-to-peer (P2P) payment apps such as Zelle, Venmo and CashApp enable users to conveniently send money directly to another user — and fraudsters aren’t afraid of exploiting them. P2P related fraud has been increasing over the last few years. With bad actors are finding very creative ways to exploit these P2P payment apps with phishing/smishing/vishing...

Press Room

Gorham Savings Adds Commercial Banker

Gorham Savings Bank, a leading southern Maine financial services institution, has hired Matt White as vice president, commercial banker. White joins GSB with over a decade of commercial banking experience at large regional banks, most recently KeyBank, where he excelled in commercial credit and relationship management. “Matt is a great addition to our growing business...

General

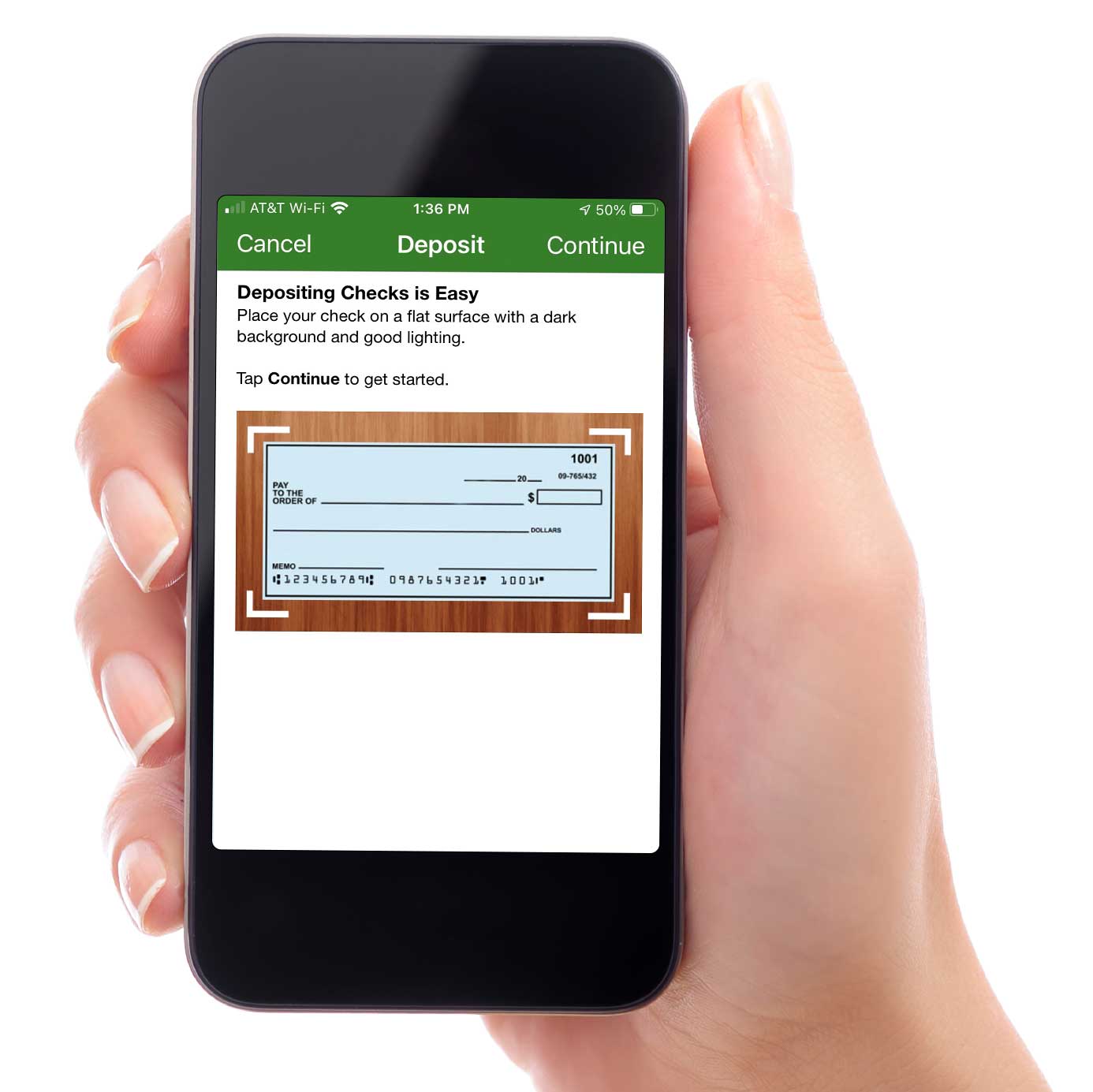

Mobile Check Deposit

Deposit checks from almost anywhere with the GSB Mobile App. Quickly make a deposit and receive a confirmation so you know right away your deposit has been received. How to deposit checks: Open the GSB Mobile App, click the Menu (+) link at the bottom of the screen and select Deposit. Sign the back of the check...

Security

Beware of Amazon Prime Day Scammers

Amazon Prime Days brings discounted prices along with new phishing scams from cybercriminals looking for any opportunity to capitalize. Phishing emails using the Amazon brand to add legitimacy top the list, but scams involving text messages and even phone calls saying they are from Amazon have been reported. These scams take into consideration the huge...

Press Room

Solar Array Dedicated to Dan Hunter in Ribbon-Cutting Ceremony

Gorham Savings Bank, a leading Southern Maine financial services institution, announced today at a ribbon-cutting ceremony that its 1.1-million-dollar investment in clean technology is now operational. The installation was formally named the Daniel P. Hunter Solar Farm after the bank’s recently retired CFO and COO who spearheaded the project. “We’re carbon neutral,” said Steve deCastro,...

Press Room

USM and Gorham Savings Bank Partner for Promise Scholars

Shared from the USM Office of Public Affairs. Jacob Curtis, a first-year undergraduate at the University of Southern Maine, is the first USM Promise Scholar to participate in a paid internship at our pilot placement employer, Gorham Savings Bank. This new initiative seeks to connect underserved students with area businesses aligned with their field of...

Press Room

Earth-Friendly Packaging Solution Earns GSB’s $50,000 LaunchPad Grant

Tanbark, a packaging manufacturer that creates custom, sustainable, recyclable, and often compostable molded fiber packaging using Maine trees and Maine labor, was named the 2022 winner of Gorham Savings Bank’s annual LaunchPad small business competition and earned its corresponding $50,000 no-strings-attached LaunchPad Grant. The company was chosen from among five finalists who pitched Tuesday afternoon...

What's New

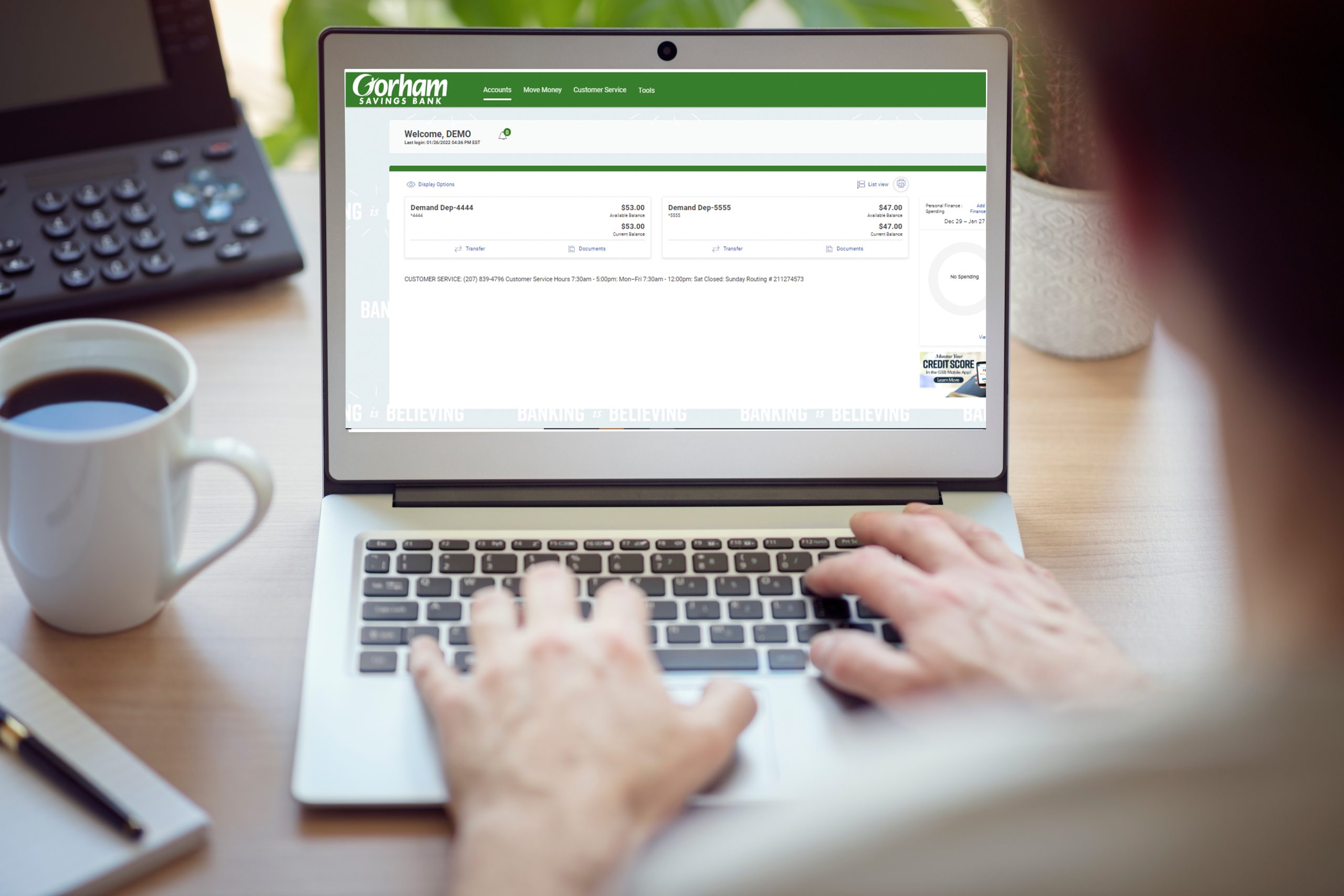

We’re Building A Better Online Banking Experience

Online Banking will soon have a more modern look and feel! Customers will be converted in stages over the next several months. As you are converted to the new system, you’ll notice: Streamlined navigation making it easier to find the tools you need to manage your finances Touch-screen technology A consistent experience between Online Banking...

Press Room

LaunchPad 2022 Finalists Announced

Gorham Savings Bank has selected finalists for its annual LaunchPad small business competition. From a diverse, statewide applicant pool of innovative small businesses, five rose to the top and will move on to the next round: a live pitch competition taking place on Tuesday, June 7 at 4:30pm at UNE’s Innovation Hall on Stevens Avenue...

Security

Account Alerts

Account and Service alerts provide real-time updates on a variety of account activities to better manage your finances. Choose to receive email or text alerts – they’re user-friendly and help you keep track of money moving in and out of your accounts to prevent overdrafts, avoid fraud and keep a closer eye on your finances....

Press Room

30-Year Banking Veteran Elevated to Chief Risk Officer

Gorham Savings Bank, a leading southern Maine financial services institution, has promoted Julie Brooks to chief risk officer (CRO) effective immediately. Brooks is responsible for the bank’s enterprise risk management program, which consists of compliance, information security, bank secrecy, fraud and audit. With more than 30 years of banking experience, Brooks joined Gorham Savings Bank...

Press Room

Julie Viola Named 2021 SBA’s STAR Award Recipient

GSB’s Julie Viola has been named the 2021 SBA STAR Award recipient. This award is given by the Maine District Office to an individual who supports the SBA’s programs and consistently exceeds expectations for their customers. Julie is being recognized for her ongoing hard work with the SBA’s 7(a) Lending Program, CEI, GPCOG, SBDC and...

What's New

New City of Portland Microenterprise Grant

The City of Portland announced a new Microenterprise grant program to aid existing and new businesses that have been or continue to be impacted by the pandemic. The grant will provide up to $7,500 in funds for rent, payroll, equipment, insurance, inventory, and other working capital needs. To be eligible: The business or nonprofit must be...

General

Register for the AHA’s 2022 Maine Heart Walk

The American Heart Association’s 2022 Maine Heart Walk will be held on Sunday, May 15 at 9:00am at Portland’s Baxter Boulevard. GSB President and CEO, Steve deCastro, is serving as this year’s volunteer Walk Chair. Steve and his committee have set a fundraising goal of $450,000 through corporate donations and walk teams. “Heart health is...

Press Room

GSB’s LaunchPad Celebrates 10-year Anniversary

Gorham Savings Bank will begin accepting applications on March 1 for its 10th annual LaunchPad small business competition – this year as a hybrid in-person and livestreamed pitch event. In the competition, the premier event of its type in Maine, innovative small businesses compete for a $50,000 grant from the bank. “Discovering an innovative and...

Press Room

Marathon Contributions, Totaling $60,000, Focus on Underserved Populations

Bob Dunfey, volunteer race director for the Maine Marathon, and Steve deCastro, president and CEO of Gorham Savings Bank, title sponsor since 2010, announced today that Stop Trafficking US, Through These Doors, Wayfinder Schools™, and World of Change are the primary race beneficiaries for 2022. Stop Trafficking US (Portland – $3,000) The organization was established...

What's New

Positive Pay can protect you from check fraud losses

Please be aware that we’ve recently seen an uptick in business check fraud, mainly from unattended mail. It’s important to have either a P.O. Box or direct delivery inside an office. If a criminal gets a hold of your checks, they’ve now obtained private business information, which not only allows them to alter your checks,...

Press Room

New COO Enhances Expertise in Finance, Strategy, and Operations

Gorham Savings Bank named Dimitri Michaud as its new chief operating officer. He will report to Steve deCastro, the bank’s president and CEO. Michaud brings nearly two decades of experience in business strategy and operations from leadership roles in the public and private sectors. Prior to joining the bank, Michaud was chief operating officer for...

What's New

Branch Lobby FAQs

1. What precautions does GSB have in place? To maintain the health and safety of our employees and customers we are observing the following COVID safety protocols. Questions? Call our Resource Team at (207) 221-8432. Have PPE and hand sanitizer available for use Utilize germ shields at teller stations and customer service desks Direct traffic...

Press Room

Gorham Savings Bank promotes New Chief Financial Officer from within

Gorham Savings Bank, a leading southern Maine financial services institution, named Jane Stack as its new chief financial officer effective January 1, 2022. She will report to Steve deCastro, the bank’s president and CEO. Stack was most recently senior vice president, controller, where she oversaw and led the Finance, Accounting, Accounts Payable, and Proof Departments....

Press Room

GSB Maine Marathon Awards Camp Susan Curtis Unexpected $20,000

The 2021 Gorham Savings Bank Maine Marathon, Half Marathon, and Relay exceeded expectations by raising a record-breaking $430,000 for nearly 40 area nonprofits. The unexpected, additional revenue allowed race organizers to brighten the holiday season for Camp Susan Curtis with a gift of $20,000. “This funding will give Maine children in need the opportunity to go to camp...

Security

Gift Card Scams

Scammers who ask for payment in gift cards often impersonate a well-known business or government agency, commonly with promises of tech or security support, which can be convincing. If you receive a call from someone claiming to be from Microsoft offering to help fix your infected computer for $200 in Target gift cards, that’s a...