BANKING IS BELIEVING

News & Events

Press Room

GSB Hires New Director of Human Resources

Gorham Savings Bank has named Brian Robinson as its new SVP, Director of Human Resources. Robinson was most recently Director of Talent Strategy and Deputy Title IX Coordinator at Bowdoin College. During his tenure, Robinson designed and implemented recruitment and retention programs with a focus on diversity, inclusion, and equity. He oversaw employee performance, conducted...

What's New

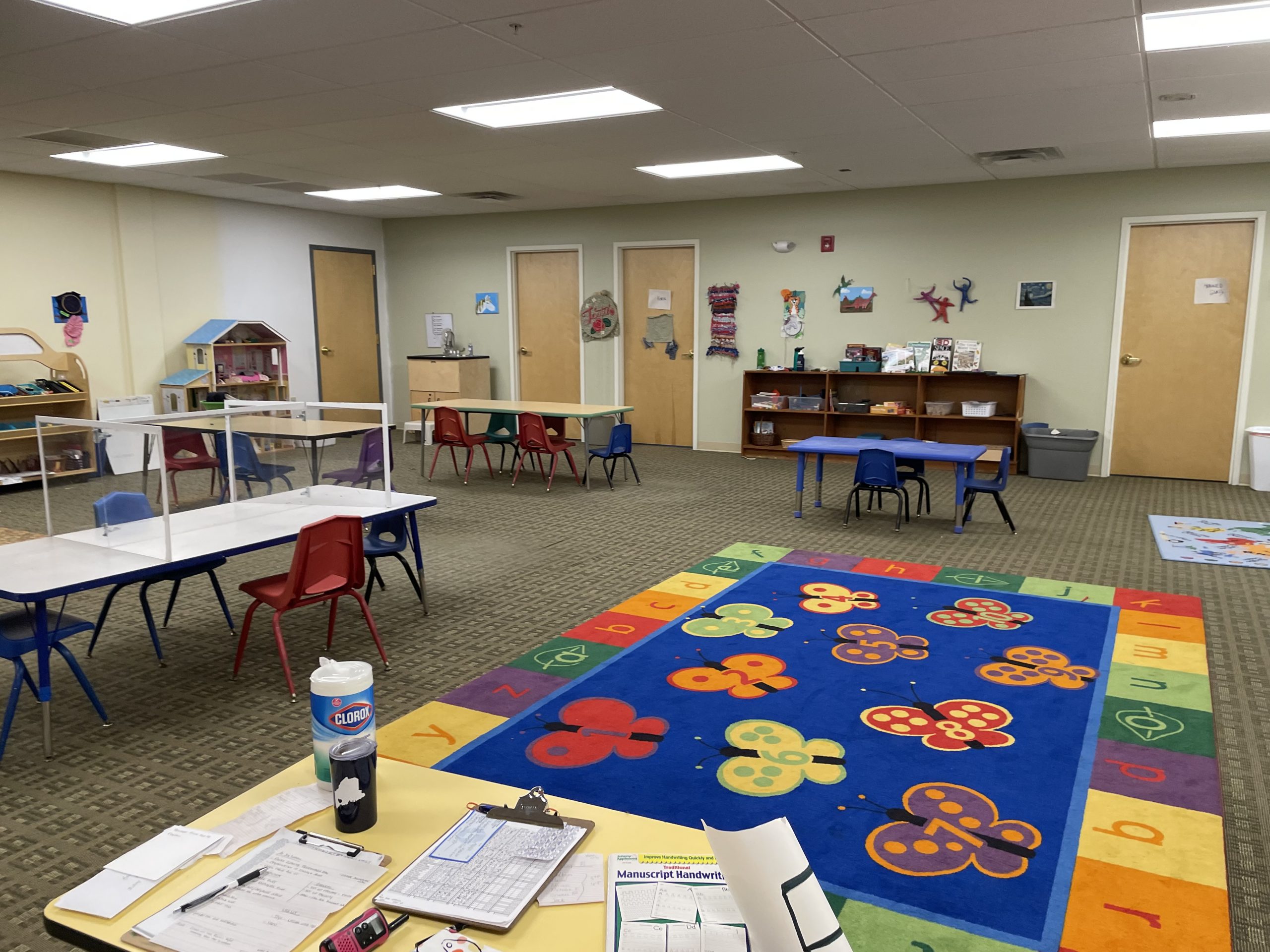

GSB Leases Space to Gorham Arts Alliance

Gorham Savings Bank is pleased to announce a unique local partnership with the Gorham Arts Alliance (GAA) to utilize the first floor of its Operations Center in Gorham for their school aged enrichment programs, homeschool and special needs art and dance programs, as well as adult education classes. The Arts Alliance was looking for a...

Security

How to Spot a Phishing Scam

Phishing is a common type of cybercrime that fraudsters use to obtain sensitive, personal information such as usernames, passwords, card numbers, or account information by posing as a trustworthy source, such as a reputable company. Phishing is commonly done through email, although social networking sites and chatting apps are becoming increasingly common methods as well....

Security

How to Spot Business Email Compromise

You receive an email from a customer requesting you view a secure document or complete a Request for Proposal (RFP). The message came from someone you’ve interacted with before, but you weren’t expecting this request. The sender’s information appears to be legitimate, and your email filter didn’t flag it as suspicious, but who is really...

Press Room

Collaboration with ReVision Energy to generate enough clean power for nearly all GSB locations

Gorham Savings Bank, a leading Southern Maine financial services institution, announced today it has broken ground on a 1.1-million-dollar solar array that when complete will offset virtually all of its electricity costs across its 12 branches and several office locations, including its 29,000 square foot Operations Center. The installation will generate 1 million kilowatt-hours (kWh)...

Press Room

Veteran Commercial Lender Kim Donnelly promoted to Director of Wealth and Business Services

Gorham Savings Bank, a leading Southern Maine financial services institution, has promoted Kim Donnelly to Executive Vice President, Director of Wealth and Business Services. Donnelly comes to the role with more than 25 years of banking experience working directly with customers. She’s led the Business Banking division since joining GSB in 2011, shepherding its growth...

What's New

2021 Child Tax Credit Payments Started July 15, 2021

The 2021 Child Tax Credit in President Biden’s American Rescue Plan provides the largest Child Tax Credit ever and historic relief to families struggling financially amidst the pandemic. If you qualify for the 2021 child tax credit, you may have already received your first advance monthly payment on or around July 15, 2021. Before you...

Press Room

Letter to the editor: New child care law an investment in Maine people, economy

This letter originally appeared in The Portland Press Herald. Thank you to Gov. Mills, Senate President Troy Jackson and others, including the editorial board of this paper, for supporting L.D. 1712. Now law, it will help more Maine families access affordable, high-quality child care programs. It is a critical investment in Maine people and Maine’s economy. As your...

What's New

Credit Insights

Credit Insights is now available in the GSB Mobile App! Access your credit score and credit report, and can gain a better understanding of the key factors that impact your score. The service is free and allows you to: View your full credit report See what affects your credit score Get personalized tips for credit...

Security

How To Increase Your Business Cybersecurity

Nearly half of all cyberattacks target small businesses. Yet only 40% of small businesses have a cybersecurity policy. Security breaches surged in the pandemic as more employees worked remotely, making data even more accessible to cybercriminals. As businesses work to recover from the COVID-19 pandemic, their vulnerability to fraud is at an all-time high. Just...

Press Room

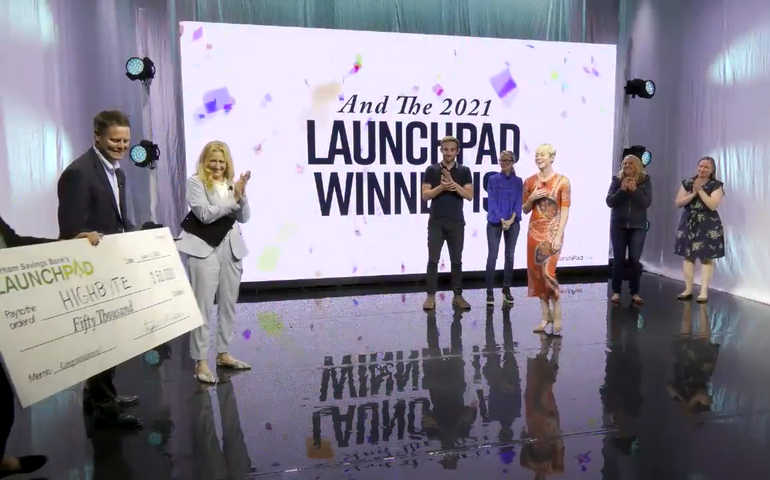

HighByte Named 2021 LaunchPad Winner

The 2021 grand prize went to Portland-based DataOps software company HighByte. GSB gives $70,000 in no-strings attached grants to small businesses. HighByte took the top prize at Gorham Savings Bank’s LaunchPad competition and its corresponding $50,000 grant. The company was chosen among five finalists who pitched Tuesday afternoon to an independent panel of judges as...

Security

Beware Of Text Messages Claiming That Your Debit Card Has Been Locked

Phishing text messages are becoming an increasingly common method for fraudsters to gain access to confidential information. Be on the lookout for text messages that claim your debit card is locked or has been blocked due to a recent transaction and ask you to respond if the activity is authorized or not, as shown in...

Press Room

GSB’s 2021 LaunchPad Finalists Announced

From a pool of nearly 150 applicants, five rose to the top and will move on as finalists to the next round of our eighth annual LaunchPad small business competition: a livestream, in-studio pitch competition taking place Tuesday, June 1 at 3:30pm. Five additional businesses have been chosen to submit a 60-second pitch video for...

Press Room

Brian O’Coin Joins GSB Commercial Banking Team

We are pleased to announce Brian O’Coin has joined our Commercial Banking team as vice president, commercial loan officer. O’Coin comes to Gorham Savings Bank with more than 16 years of expertise in commercial lending, having worked with customers across Southern Maine and New Hampshire ranging from small, local businesses to regional middle-market companies. Most...

What's New

A Third Round of Stimulus Checks

With Congress recently approving a $1.9 trillion COVID-19 relief bill, a third round of economic impact payments (stimulus checks) is expected starting March 17th. The bill provides $1,400 to individuals making up to $75,000 per year and $2,800 to couples making up to $150,000, with payments phased out for higher incomes. An additional $1,400 payment...

Press Room

Letter to the editor: Lack of access to quality early learning economic issue for Maine

This letter originally appeared in The Portland Press Herald. Your recent news article (Jan. 27) and editorial (Jan. 29) on a report titled “Early Childhood Programs’ Scarcity Undermines Maine’s Rural Communities” caught my attention. From a business perspective, the lack of access to quality early learning and child care programs faced by rural children and...

Press Room

LaunchPad 2021 Application Opens March 1

Gorham Savings Bank will begin accepting applications on March 1 for its eighth annual LaunchPad small business competition, the premier event of its type in Maine, which will be a livestream event this year. In the competition, promising small businesses will compete for a $50,000 grant from the Bank. “We’re truly excited to bring LaunchPad...

What's New

Touch-Free Payments With Contactless Cards

Speed, simplicity, and security wherever the contactless symbol is displayed Gorham Savings Bank is now issuing contactless debit cards. When you receive your new GSB card, just look for the contactless symbol when paying for items, tap your card against the symbol on the payment terminal until the light turns green, and listen for a...

Press Room

New program will provide aging Mainers with at-home access to health and wellness services

The Westbrook Housing Authority (WHA) and the University of New England Center for Excellence in Aging & Health (UNE CEAH) have signed a memorandum of understanding to establish a three-year, multi-phase student placement and research partnership serving seniors aging in place in affordable housing, made possible by a $20,000 grant generously provided by Gorham Savings...

General

A Second Round of Stimulus Checks

With Congress recently approving a $900 billion COVID-19 relief bill, a second round of economic impact payments (stimulus checks) is expected starting the week of January 4th. The bill provides $600 to individuals making up to $75,000 per year and $1,200 to couples making up to $150,000, with payments phased out for higher incomes. An...

Press Room

Maine District Office Presents GSB With SBA 504 3rd Party Lender of the Year Award

Gorham Savings Bank was awarded the U.S. Small Business Administration’s 504 3rd Party Lender of the Year in Maine for completing 10 504 loans totaling more than $2.2 million which, when combined with SBA’s portion of the loans, represented almost $4.7 million in financing and more than 60 jobs created or retained. SBA 504 loans...

Security

Should A Company Pay A Ransom?

Ransomware attackers specialize in penetrating corporate networks, and sometimes specifically target a business’ backup systems, making it difficult – or impossible – to remediate the harm of an attack. The frequency and size of ransomware incidents have increased significantly in recent years. No company is safe from being targeted. How You Can Help Protect Your Business...

What's New

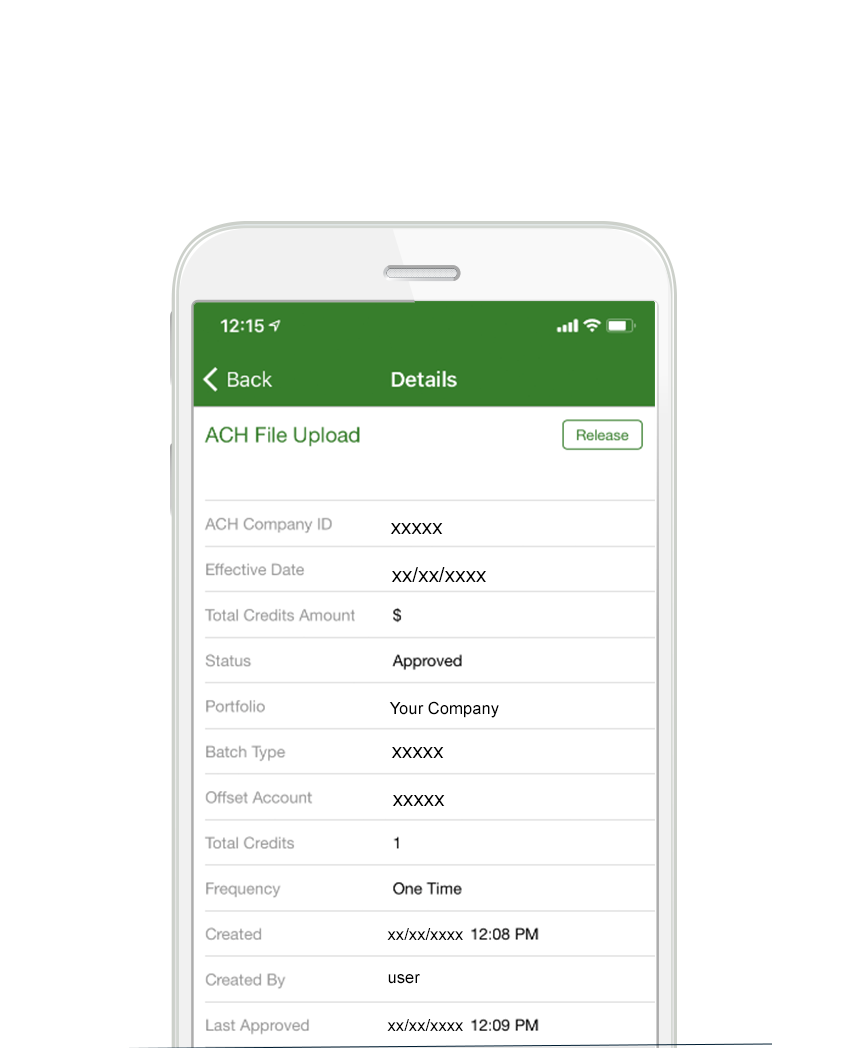

Approve ACH or Wire Payments On-The-Go

With mobile approval for ACH and wires, it’s more convenient than ever for businesses to increase security and utilize dual control. Authorized users can quickly and easily approve, or release, ACH and wire payments on-the-go with the GSB mobile app. Requiring a second approver for ACH originations and wire transfers will give you peace of...

Security

SBA PPP Borrower Data Publicly Released

Third-party businesses are using information from a court-ordered public release of Small Business Administration (SBA) Paycheck Protection Program (PPP) borrowers to deceptively market themselves. Their communications may reference Gorham Savings Bank and may even imply that we have an affiliation. Please be aware that we will communicate directly with you about your PPP loan and...

General

Tourism, Hospitality & Retail Recovery Grant Application Opens 12/3

On November 30, 2020, Governor Mills announced a $40 million economic recovery program to support Maine’s tourism, hospitality, and retail small businesses. The Tourism, Hospitality & Retail Recovery Grant Program is focused specifically on supporting Maine’s service sector small businesses, such as restaurants, bars, tasting rooms, lodging and retail shops, which have been hard hit...

Press Room

Virtual GSB Maine Marathon Raises More Than $250,000

The Marr Foundation raised $212,000 alone, exceeding its goal of $200,000 Despite being run virtually over 2-weeks this year, the 2020 Gorham Savings Bank Maine Marathon, Half Marathon, and Relay, exceeded fundraising expectations, finishing strong with just over $254,000. Nearly 50 percent of race participants made a donation or donated their registration fee to charity – a 40...

What's New

GSB Mobile App – Deposit A Check, Pay Back A Friend & More

The GSB Mobile App makes managing your money from home or on-the-go convenient and easy. Simply download the Gorham Savings Bank app for iOS or Android to deposit a check, pay back a friend, lock a lost or misplaced GSB debit card, and monitor credit and account activity to help protect against fraud. With The...

Security

SBA COVID-19 Relief Scams and Fraud Alerts

Please be aware of a variety of malicious attempts by cyber-criminals taking advantage of the Small Business Administration (SBA)’s COVID-19 relief efforts to gather sensitive information and steal funds from businesses. Always think before you click! Grants/Loans The SBA does not initiate contact on either loans or grants. If you are proactively contacted by someone...

Press Room

Gorham Savings Bank Maine Marathon Goes Virtual

Due to the ongoing uncertainty surrounding the COVID-19 pandemic, the 2020 Gorham Savings Bank Maine Marathon, Half Marathon, and Relay, originally scheduled for Sunday, October 4, will take place virtually over two weeks. Title sponsor Gorham Savings Bank will cover all virtual race costs incurred so that every virtual entry fee dollar can be donated...

What's New

PPP Loan Forgiveness Program

The SBA has created two applications – PPP Loan Forgiveness Application Form 3508EZ and PPP Loan Forgiveness Application Form 3508. Please refer to Application Form 3508EZ Instructions for Borrowers and Application Form 3508 Instructions for Borrowers to determine which application should be completed. Additional information regarding the use of SBA Form 3508EZ is also included...